It has been only a few hours since PanamaPapers got published and a lot is happening

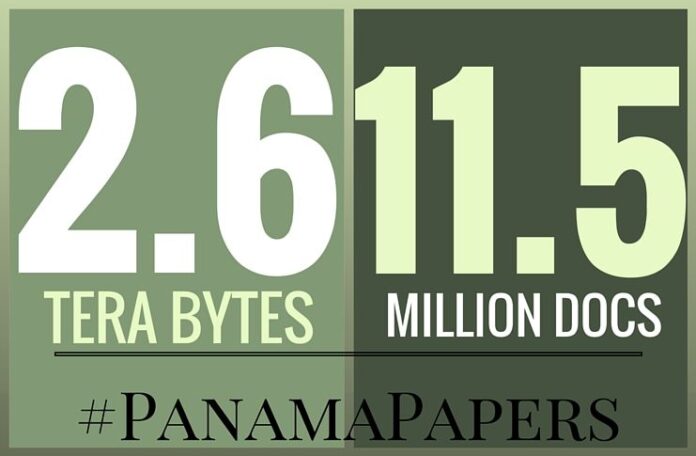

That ICIJ was going to drop this bombshell of a leak (11.5 million documents, to be precise) was totally out of the blue. The total size of these revelations is 2.6 Tera bytes, making it the biggest ever till date.

PanamaPapers: Here is what you need to know

-

What this really is: The cache reveals assets of everybody from governmental administrators to billionaires to celebrities to sports persons that have till date been undisclosed. The documents uncover holdings of at least 12 world leaders past and present. Information on the hidden monetary purchases of 128 politicians and officials worldwide along with at least 33 people blacklisted from the U.S. government because of links to wrongdoing. These include using the services of terrorist organizations, drug lords or rogue countries for instance Iran and North Korea.

-

Why should you care: The documents’ flow shows how the famous and the rich may manipulate tax shelters and reveals a methodology adopted by them for 40 years, including maneuvers by main banks who made the tough-to-track corporations. Acquaintances or World leaders who have loudly proclaimed that they are against Corruption programs are exposed through and through. The reports also allege a billion-dollar money laundering operation by a Russian bank linked with associates of Russian President Vladimir Putin.

-

What shell organizations are: A Shell Corporation is one with no considerable assets or businesses used like a vehicle for different financial dealings. It could also be one that is held dormant for future use. Shell companies are not illegal. Corporations put possessions in offshore constructions for various motives, for example to bypass currency limits. They are used by other folks in estate planning. Nevertheless, they are usually used even to make fraud or as tax havens, for example producing an “vacant” cover business having a title just like a one that was real, then working up the price of the empty cover and promoting it.

-

What Mossack Fonseca is: Mossack Fonseca is actually a law firm located with more than 40 offices worldwide that is headquartered in Panama. It focuses on trader advisory, trust solutions, professional regulation and international structures. It works in tax-haven nations such as Switzerland and several Caribbean countries, which used to be British subjects. In a terse response, Mossack Fonseca rejected all allegations of illegal activity.

-

Exactly what the fallout could possibly be: Laws differ by place, and it remains to be seen whether any global conventions were broken or perhaps the money may be returned. Nevertheless the political fallout has already started (see below).

Here is a quick update on the fallout of this in various countries:

-

Iceland – Iceland’s Prime Minister, who figures in the PanamaPapers was expected to call a snap poll so he could explain it to the Icelanders. For a few moments, thanks to a loss in translation it actually looked as if Prime Minister Sigmundur Gunnlaugsson had resigned outright. The confusion happened when Gunnlaugsson’s predecessor called on him to step down — Google translated the Icelandic “must resign” as “will immediately resign.”

-

Russia – Vladimir Putin’s spokesman, Dmitry Peskov, told reporters that the Kremlin had already received “a series of questions in a rude manner” from an organization that he said was trying to smear Putin. “Journalists and members of other organizations have been actively trying to discredit Putin and this country’s leadership,” Peskov said. But beyond this, he refused to answer any questions about the allegations.

-

Australia – The Australian Tax Office (ATO) said it had linked more than 120 of the clients “to an associate offshore service provider located in Hong Kong.” ATO Deputy Commissioner Michael Cranston said that his office was working with the Australian Federal Police, the Australian Crime Commission and anti-money laundering regulator AUSTRAC. This is the most active country as of now.

-

India – Indian Express carried a news item on this, listing a few famous personalities such as Amitabh Bachchan and Aishwarya Rai Bachchan. It also mentions corporates such as DLF owner K P Singh and nine members of his family, and the promoters of Apollo Tyres and Indiabulls to Gautam Adani’s elder brother Vinod Adani. The government is yet to issue a statement.

- Supreme Court rejects plea to tally all VVPAT slips with EVM votes; says ‘no going back to paper ballot’ - April 26, 2024

- US report citing human rights violations is deeply biased: India - April 25, 2024

- Kotak Mahindra Bank shares tank 13%. Market Cap erodes by Rs.37,721 cr post-RBI action - April 25, 2024

The biggest financial terrorists do not figure in the list … Looks like a pointed expose on Vladimir Putin !!!

Nothing much will happen from these disclosures apart from selling few newspapers.Look at Modi the chaiwallah,he came with a big fanfare but if you closely analyse his statements,no where has he made any that says that he will go after crooks.He is the hindutva version of karunanidhi,will insinuate about other corrupts,get into power but once in power,will go silent.Similar characters exist in every country.All bunch of weak rulers and deviants.