Does US Fed know what lies ahead?

The pause by the US Federal Reserve in the June meeting while still indicating at least a couple of hikes ahead is indeed perplexing. At least on the surface. If the economy is strong, unemployment low, and consumer price inflation high, would it not warrant a hike? Maybe there are other reasons as I will explain.

I am sure the US Fed knows what lies ahead – perhaps in the next few months if not weeks. A tsunami of housing foreclosures and banking collapses is imminent. There is no way to prevent the 2008 redux at this point even if no further rate hikes are forthcoming. The artificial boom caused by an unprecedentedly lax combination of fiscal (from a national debt of $ 9 trillion to more than $32 trillion today) and monetary policy (practically ZIRP for the entire duration) over the last decade and a half is indeed in its last legs.

So how does it play out in the years ahead? Technically, 4 possible options depending on the choices made by the US government and the Federal Reserve. The common theme amongst all the 4 options is an economic depression.

There is no standard definition of “depression”. For the purpose of this article, let’s say it is a prolonged period of economic contraction lasting more than a few quarters with cumulative GDP contractions in the double digits. Not a pretty picture.

As followers of Von Mises will know, depression is not the problem but indeed a central part of the cure to the disease caused by an artificial credit-induced boom. We have tremendous malinvestments and the process of reallocating resources from the bubble industries to capital-started ones cannot happen without a recession/ depression.

** – The deflation after the 1929 stock market crash did not cause the Great Depression as is most commonly believed. Deflation, or falling prices, made the depression more tolerable than would otherwise have been the case. Read “America’s Great Depression” by Murray Rothbard to understand further.

Monetary Policy

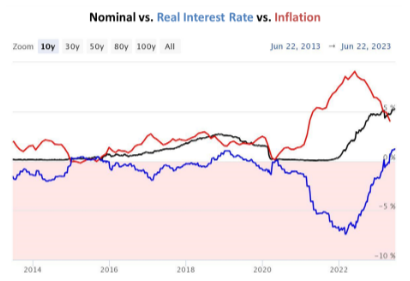

The nominal interest rates would indeed be a very misleading way to judge monetary policy going forward. While in the last 18 months, there has indeed been a movement towards a positive real interest rate regime (albeit using numbers that grossly understate the real inflation in the economy), we are probably very close to the peak in terms of real interest rates.

So while the Fed might increase rates in the future, it does not necessarily mean that the monetary policy is becoming tighter. In fact, it is more than likely that the real interest rates start deteriorating going forward indicating a loosening of the monetary policy stance. Far more appropriate indicators of the soundness of the monetary policy would be the size of the Fed balance sheet or the growth in the money supply.

When these factors – the size of the Fed balance sheet or the growth in Money Supply ebb and flow with changes in real GDP rates, it could be considered as a tight monetary policy. Of course, we are nowhere near that and perversely the growth in Money supply is substantially higher during recessions. Keynes has provided the intellectual cover for that practice. A very flawed rationale at that and this has essentially ruined what was an industrial powerhouse that the US was to an economic basket case today.

Fiscal Policy/ Regulatory Approach

This is one area where the US Federal government has veered so far away from its intended purpose that the US founding fathers would turn in their graves today. They had envisaged only 2 functions for the federal government – providing security from external/ internal aggressors (army/ police) and enforcement of contracts (the justice system). So there is zero probability of the type of hands-off approach that was done as a response to the 1920-21 crash.

Deficits of several trillions would be the order of the day even with a mild recession. A balanced budget, what was done during the 1920-21 downturn, would be considered very pernicious by most economic think tanks and policymakers today. Even the most conservative economist today would not advocate such an approach.

What I meant by “Leaning towards Laissez Faire” is just a directional movement and not an absolute indicator. Forget balanced budgets – that is not even with the realm of possibilities. If all that is delivered are deficits of the order of $1 trillion as a response to the oncoming crash, we would have to consider that as leaning towards limited government.

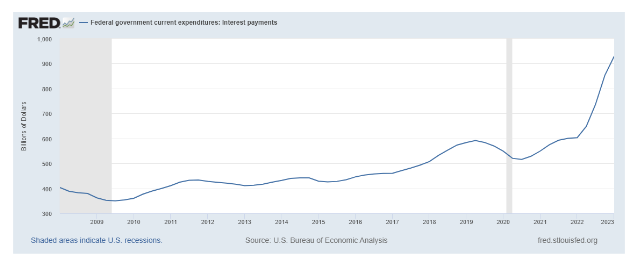

However, we should not be surprised with a nominal “5 Trillion” handle on the deficits sometime during the next few years. After all, the US government is running a 2 trillion deficit during years of supposedly strong growth, low unemployment, and ultra-low rates on their borrowings. A net 5% interest rate today would mean a 1.5T interest obligation on the current national debt of $32 trillion. We are really close to hitting the $1T annualized rate on interest payments as we speak on projected revenues of $5 T.

The Most likely path forward

I have outlined four possible scenarios on how this would play out: Option A being the best-case scenario with Option D being the worst case. What however we need to discuss is which of these options is most likely to be made by the policy makers. Make no mistake – this is clearly an explicit choice that is being made and that is largely reflective of the intellectual bankruptcy of the economists and “kicking the can down the road” attitude of the political class. Let us start with the deflationary options.

A – A short but severe deflationary depression.

B – A prolonged deflationary depression.

The widespread perception that deflation caused a depression – amongst the public, think tanks, and even the Fed officials – will ensure that the Fed will never allow this to happen. Bernanke actually believes that the gold standard adopted by the then-US Fed caused the depression.

“Regarding the Great Depression, … we did it. We’re very sorry. … We won’t do it again.”

—Ben Bernanke, November 8, 2002

Though Option A would be the ideal response, there is little hope that academicians and policymakers understand the value of not treating an economic depression. The ideal antidote to the current policy thought processes would be Jim Grant’s book “The Forgotten Depression: 1921: The Crash That Cured Itself”.

Let us now look into what is most likely to happen.

C – Inflationary Depression

D – A Hyperinflationary Depression

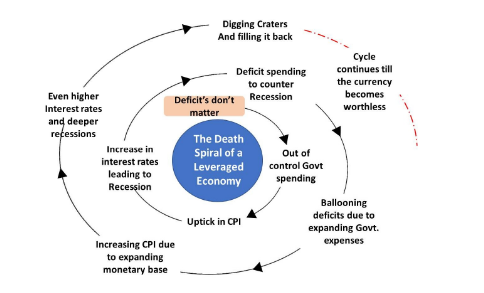

The figure above describes how fiat currencies lose their value over a period of time. The inflationary death spiral is something that has been witnessed perhaps thousands of times over the course of history. In fact, the probability of a fiat currency going through the end stage of the inflationary death spiral is 100%. So why should the US Dollar be any exception to this rule? The only uncertainty is the time associated with the cycle playing itself out and oftentimes, it spans decades. Especially with the larger and more developed economies.

That the US Dollar has survived in its current unbacked form for more than 50+ years (since the US closed the gold window in 1971) is itself an economically inexplicable phenomenon. More than anything else, it reflects the abysmal state of understanding of basic economics in the world. The Emperor of Central Banking has been naked for decades and barring Putin and a couple of other recent exceptions, nobody has called the US Fed out for the game it has been playing.

The question to be answered now is this – Will we witness another 1970s-style high-inflationary cycle in the US without the US dollar reaching its intrinsic value of zero in this cycle? Or in other words, is it going to be Option C or Option D?

The only reason why the US Dollar even survived the 1970s cycle was that the US Fed under Paul Volcker raised the short-term rates to 20%+ and offered a real inflation-adjusted return of at least 5% on the US Dollar holdings. That is an impossibility today. Even with the enormously understated inflation numbers, the US Fed will struggle to offer a positive yield and so it is very unlikely that we have large-scale demand for the US Dollar – both from private investors or from foreign Central Banks. This is a trend that we have been witnessing for the last few years and this will only intensify in the years ahead.

What this implies is that deficits of the US government have to be pretty much entirely monetized by the US Federal Reserve going forward. The FCBs used to hold a substantially higher proportion of US Treasuries as compared to the US Fed till 2020. But over the last 3 years, this ratio has entirely reversed and the additional treasury purchases have been done exclusively by the Federal Reserve.

Barring a miracle, there is very little that can stop the deterioration of the US Dollar’s value and the US Economy in the months ahead. As Hemingway would put it – “Gradually and then suddenly”.

Conclusion

The probability for a much worse than the 1970s inflation or perhaps even hyperinflation in the US Dollar looks to be a very high one. The sequence of events is more or less likely to follow the pattern outlined below:

- Start of a deep recession in the US Economy due to a 2008 Redux. The housing bubble is far bigger than the one that started the 2008 Great Recession and the effect on the fragile banking system is going to be much worse. I have to remind readers that the stress test for the banks never included a stagflationary scenario i.e. increasing interest rates and a recession.

- The above is to going to result in a severe recession with plunging asset prices and a run on the banking system. While the ideal response for the US government and the Fed would be to just step back and allow the market cleansing purpose to clear out the malinvestments that is unlikely to happen.

- The US government would respond with a gigantic stimulus to the tune of several trillion dollars.

- This deficit would have to be monetized entirely by the US Fed due to a declining appetite for US Dollars amongst investors. The negative real interest regime that is likely to be the scenario for the foreseeable future guarantees that none of the FCBs are going to be big buyers of US treasuries.

- This will lead to higher CPI resulting in higher market interest rates and deeper recessions i.e. the inflationary death spiral of a leveraged economy.

We are at the early stages of the end game for the US Dollar and indeed the US Economy itself. The warning signs have been loud and clear for long. But never as obvious as is the case today and one doesn’t have to be a Von Mises to understand this now.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023

[…] Source Link […]