European Central Bank (ECB) has decided to withdraw the Euro (€) 500 note

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]A[/dropcap]ccording to Handelsblatt, a leading German media publication, the ECB has decided to withdraw the Euro (€) 500 note. Despite Germany’s objections, ECB intends to do this in a move to fight money laundering. The idea is opposed by Germany, which still uses cash more than most other countries in Europe.

…eliminating high-value notes that are rarely used would help deter tax evasion, financial crime, terrorism financing and corruption.

So why is Germany objecting to this? It’s because most Germans still use cash for their day to day transactions. Only 18% of all transactions in Germany are done using credit cards. One may argue that people will still have 5, 10, 20, 50, 100 and 200 euro bills to do their transactions…

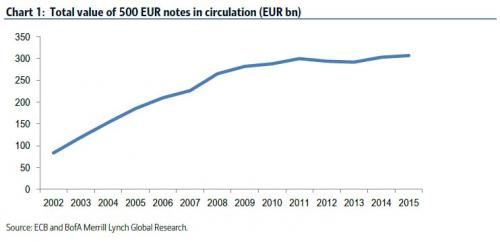

Well, it is not that simple. The €500 note is the second highest currency denomination in G10 (Group of 10), after the CHF1,000 (a 1,000 Swiss Franc note issued by the Swiss National Bank) note. More importantly, the total value of €500 notes in circulation amounts to €306.8bn and has been rising as shown in this Bank of America (BofA) chart:

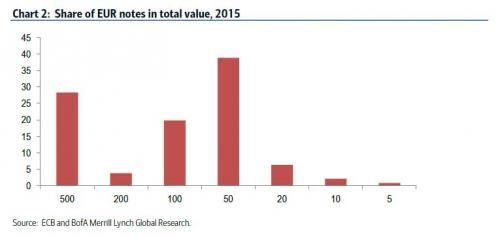

Additionally, the €500 note is the second most used currency bill in the G10, as shown in this BofA chart.

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]T[/dropcap]his is significant. If the €500 were withdrawn, it would reduce the amount of physical currency of Euros by 30%. That would mean the Euro (€) circulation would shrink to €700 billion! While mentioning all this, BofA also cautioned that such a move could weaken the Euro against the Dollar.

On Feb 8th, Peter Sands, the former head of Standard Chartered Bank argued, in an academic publication that eliminating high-value notes that are rarely used would help deter tax evasion, financial crime, terrorism financing and corruption.

Peter Sands, is now a senior fellow at the Harvard Kennedy School in Massachusetts and an advisor to the Singaporean central bank.

“Without being able to use high-denomination notes, those engaged in illicit activities — would face higher costs and greater risks of detection. Eliminating high denomination notes would disrupt their ‘business models’,” Sands’ report said.

Does this apply to India?

Assuming that there is a grain of truth in what Sands says, it would almost immediately imply that India should consider withdrawing ₹500, ₹1000 bills. I can think of several reasons:

- The common man can get by with ₹100 (and if necessary a ₹200 note).

- As much as 2% of the Payouts in betting events run by punters is counterfeit currency.

- The paper that is used to make India’s currency is the same as its hostile neighbor Pakistan(De La Rue). In fact Prime Minister Modi called for the currency paper to be manufactured in India itself in October 2014. It is not known as to when these notes will get into circulation.

- There have been allegations of UPA making it easy for Pakistan (specifically the ISI) to print fake Indian currency notes and thereby destabilize India.

- A rumor doing the rounds is that fake currencies enter mainstream through Post Offices. In the rural areas, the Post Office is often the bank of choice. If you have an account in a Post Office and wish to transfer money out of it, you are advised to do so electronically.

The United States may or may not do away with the $100 bill but as far as India is concerned, fake currency is a clear and present danger. Doing away with higher denominations will certainly help combat Black Money in the country. Will they?

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023